Summary of Book “Rich Dad Poor Dad”

5 Life Changing Lessons From best selling book “RICH DAD POOR DAD”

Lesson 1.“Pay Yourself First”

Pay yourself first” is a golden statement of personal finance. It means when

you receive your paycheck at the end of a month you should put about 10-20

percent of money into voluntary provident funds, banks, or any other saving

The advantage of paying yourself first out of your salary or paycheck is that

financial emergencies, such as car breakdown, financial crisis, or unexpected

medical expenses. When people don’t save money before spending they experience

Lesson 2: “The rich don’t work for money”

The rich don’t work for money. What does it mean? It means the rich don’t get

paid for their hard work, but they are paid for their smart work. Okay, let’s

You have seen many entertainers, singers, sports players today are income

earn a lot but for a limited time. If you’re working for money you will become

a high-income earner at best. That doesn’t make you rich.

If you’re rich then you have an income of a million-dollar per year without

doing any effort. Warren Buffet, the CEO of Berkshire Hathaway says, “If you

don’t find a way to make money while you sleep, you will work until you die”.

amount of wealth and assets for making you a true rich.

Lesson 3: ” Identify your assets and liabilities”

According to Robert Kiyosaki, an asset is something that puts money in your

pocket while a liability is something that takes away money from your pocket.

Most of us think that our house is an asset. Besides, our financial planner,

real estate agent, and accountant all call our house an asset. But, In

reality, our house is not an asset, it’s a liability.

If you live in a house, paid for or not, then it isn’t an asset since it

doesn’t put money in your pocket, instead, it takes money out of your pocket

in the form of a mortgage, utility payments, taxes, maintenance, and more.

That is what liability is.

Lesson 4: “Buy luxury last, not first”

Poor and middle-class people ( including myself) tend to buy luxuries first

immediately after receiving their paychecks. I have observed many of my

friends rush to shopping malls to buy expensive clothes, new smartphones, and

Too many people spend money they haven’t earned to buy things they don’t want

to impress people they don’t like. ~Will Smith

Most of us buy unnecessary things just to impress other people. We are unaware

that wealth is created by maximizing earnings as much as possible, saving

those earnings wherever possible, and maximizing returns.

When we invest our savings intelligently and apply the laws of compounding

within few years we see our desired wealth growth.

The wealthy mindset saves now and spends later.

The middle-class mindset spends now and saves later.

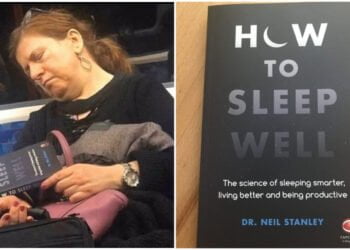

Lesson 5: ” Read a Lot”

Just like eating a balanced diet every day keeps you healthy and fit, reading

books keeps your mind sharp and makes you more skillful and knowledgeable.

Successful people feed their minds every day by reading both fiction and

nonfiction books. Besides, they solve many other kinds of brain games such as

crossword puzzles and brain teasers.

The more you read and learn, the more you become wiser. Reading helps you to

retain information and knowledge.

“I had a lot of dreams when I was a kid, and I think a great deal of that grew

out of the fact that I had a chance to read a lot.”

-Bill Gates